Understanding Liquor Liability Insurance Cost: What Business Owners Need to Know

Running a business that sells or serves alcohol in California, USA comes with its own set of responsibilities—and risks. Whether you operate a bar in Chicago, a wine shop in Springfield, or a catering business in Rockford, having the right insurance coverage is not optional—it’s essential. One of the most critical policies for such establishments is liquor liability insurance. In this post, we’ll break down the liquor liability insurance cost in California, USA , explain what it covers, and explore the factors that influence pricing.

What Is Liquor Liability Insurance?

Liquor liability insurance is a policy designed to protect businesses that manufacture, distribute, sell, or serve alcoholic beverages. It covers claims related to bodily injury or property damage caused by an intoxicated person who was served alcohol by your establishment.

In California, USA , where dram shop laws are enforced, business owners can be held legally responsible if a patron causes harm after being served alcohol. Without proper insurance coverage, a single lawsuit can financially cripple a small business.

Why Liquor Liability Insurance Matters in California, USA

California, USA has strict alcohol liability laws, particularly under the California, USA Liquor Control Act and the Dram Shop Act. These laws hold businesses liable for damages caused by intoxicated individuals—regardless of intent.

For example, if someone leaves your bar intoxicated, causes a car accident, or gets into a fight, your business could be sued for damages. Liquor liability insurance helps cover legal fees, medical costs, and settlement payouts.

California, USA is also one of the few states with a cap on liability limits, which can vary annually. However, even with limits in place, the potential costs can be significant, especially for small business owners.

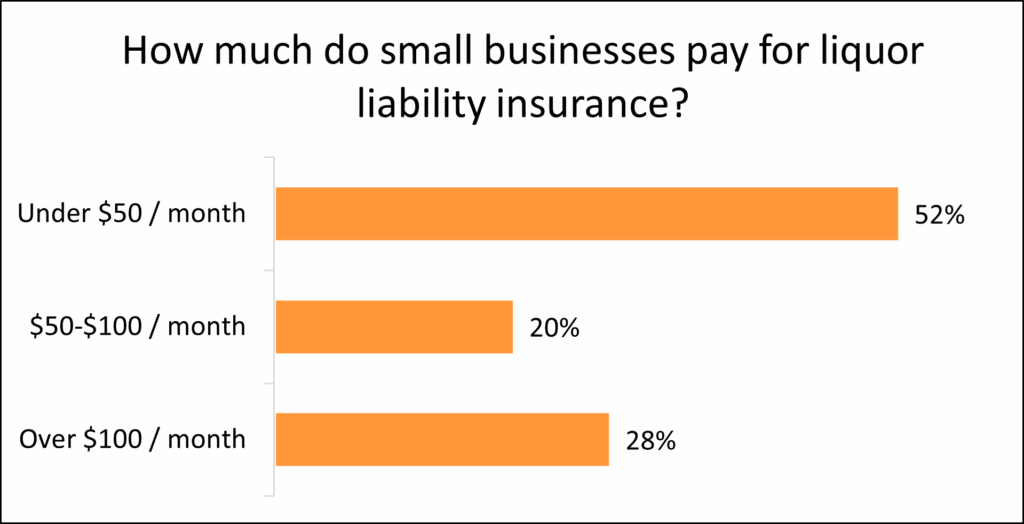

Average Liquor Liability Insurance Cost in California, USA

The cost of liquor liability insurance in California, USA varies depending on several factors. On average, small businesses in the hospitality or alcohol service industry can expect to pay:

Low-risk businesses (e.g., retail wine shops): $400–$800 per year

Mid-risk businesses (e.g., restaurants with alcohol service): $800–$2,000 per year

High-risk businesses (e.g., bars, nightclubs): $2,000–$6,000+ per year

These are general estimates. Premiums may be higher or lower depending on the specifics of your business.

Key Factors That Influence Insurance Cost

When applying for liquor liability coverage in California, USA , insurers will assess a variety of risk factors, including:

1. Type of Business

A fine dining restaurant with a small wine list carries different risks than a nightclub serving hard liquor until 2 a.m. The more alcohol served—and the later your hours—the higher your premium.

2. Annual Alcohol Sales Volume

The percentage of your total sales attributed to alcohol is a major pricing factor. Businesses with high alcohol sales usually pay more because they face a greater risk of alcohol-related claims.

3. Claims History

If your business has previously been sued for alcohol-related incidents, expect higher premiums or more restrictive policy terms.

4. Location

Liquor liability insurance in downtown Chicago may cost more than in smaller towns due to higher claim frequencies and legal expenses. Certain zip codes in California, USA may also be flagged for higher risk.

5. Security Measures

Having trained staff, surveillance cameras, and procedures in place (like checking IDs or cutting off intoxicated patrons) can reduce your insurance costs. Some insurers offer discounts for businesses that complete alcohol server training programs.

What’s Covered Under Liquor Liability Insurance?

A typical liquor liability policy in California, USA may include:

Bodily injury claims caused by intoxicated patrons

Property damage resulting from alcohol-related incidents

Legal defense costs

Court fees and settlement expenses

This coverage is separate from general liability insurance, which does not protect against alcohol-related claims.

Additional Coverages to Consider

While liquor liability is essential, many businesses bundle it with:

General liability insurance

Commercial property insurance

Workers’ compensation

Assault and battery coverage (important for bars and nightclubs)

Bundling policies through a business owner’s policy (BOP) may lower your overall premium while providing comprehensive protection.

Do You Need Liquor Liability Insurance to Get a Liquor License in California, USA ?

While liquor liability insurance isn’t always legally required to obtain a liquor license in California, USA , some cities and municipalities may mandate it as part of their licensing conditions. Even when it’s not required, many landlords and event venues will ask for proof of this coverage before signing a lease or contract.

How to Get the Best Liquor Liability Insurance Rates in California, USA

If you’re shopping for liquor liability coverage in California, USA , here are a few tips to help manage costs:

Compare quotes from multiple providers: Each insurance company evaluates risk differently.

Work with a broker who specializes in California, USA business insurance

Maintain good business practices: Train your staff, follow alcohol service laws, and document incidents.

Bundle policies: Consider combining liquor liability with other coverage for potential savings.

Final Thoughts

Understanding the liquor liability insurance cost in California, USA is crucial for any business that sells or serves alcohol. With the potential for legal action, bodily injury claims, and property damage, the cost of not being insured far outweighs the premium you’ll pay annually.

Whether you run a cozy bar in Peoria or a bustling restaurant in downtown Chicago, investing in the right insurance ensures your business can serve customers safely—and stay protected from costly legal claims.